We are looking at what appears to be a relief rally after wiping out nearly 3 trillion dollars in global wealth over a couple of trading days. Yesterday was a very odd day as gold climbed but the miners did not follow. Volatility remained fairly tepid as the markets broke through what should have been considered significant technical support. Oil was weak pulling down the energy names as the dollar continued its strength. Biotech, transportation, financials, retail, semiconductors, tech, retail, home builders, aerospace & defense, small caps, mid caps, it didn't matter where you looked there really wasn't anywhere to hide accept for the utilities sector.

This morning we are seeing a small bounce premarket after a little relief rally around the globe.

We may have a gap and grind kind of day here in our markets as we try to find some solid footing. We have done some significant technical damage and what was support should now become resistance. There may be some short term trading opportunities but we have a lot of work to do before the markets would start to look healthy again. We have been conditioned over the last eight years to buy the dip. Like we talked about this weekend on Ticker TV > one of these times buying the dip isn't going to work. Tread carefully out there and keep your caution cap on.

Don't chase anything and make sure you have a clearly defined risk reward plan.

Don't Miss Out!

NEW FREE CHAT ROOM

NEW WEBSITE

NEW LOOK

SIGN UP

Today's Markets

In Asia, Japan +0.1% to 15323. Hong Kong -0.3% to 20172. China +0.6% to 2913. India+0.5% to 26525.

In Europe, at midday, London +2.5%. Paris +2.5%. Frankfurt +2.1%.

Futures at 6:20, Dow +1.1%. S&P +1%. Nasdaq +1%. Crude +2.6% to $47.54. Gold -1%to $1311.

Ten-year Treasury Yield +2 bps to 1.48%

In Europe, at midday, London +2.5%. Paris +2.5%. Frankfurt +2.1%.

Futures at 6:20, Dow +1.1%. S&P +1%. Nasdaq +1%. Crude +2.6% to $47.54. Gold -1%to $1311.

Ten-year Treasury Yield +2 bps to 1.48%

Today's Economic Calendar

8:30 GDP Q1

8:30 Corporate Profits

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

8:30 Corporate Profits

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

ETF's on my Radar

Volatility OIL Biotech

UVXY XIV VXX TVIX UWTI DWTI GUSH DRIP USO LABD IBB LABU

VMIX VMAX

UVXY XIV VXX TVIX UWTI DWTI GUSH DRIP USO LABD IBB LABU

VMIX VMAX

Gold SILVER Dollar Financials

GLD NUGT JNUG USLV UUP FAS XLF FAZ HYG JNK

Minerals and Miners Utilities RETAIL Transportation

XME GDX GDXJ XLU XRT IYT XTN

DUST JDST

Agriculture SPY

DBA, DAG SPXS SPXL

STOCKS ON MY RADAR PREMARKET

SCYX buys 100k @ 2.39 Book value 2.52 small floater

MGNX pr also flirting with a 23 roll small float getting upfront payment of 75 mil announced the deal in May

NDRM PR gapper premarket tiny floater

*PR = Press Release*

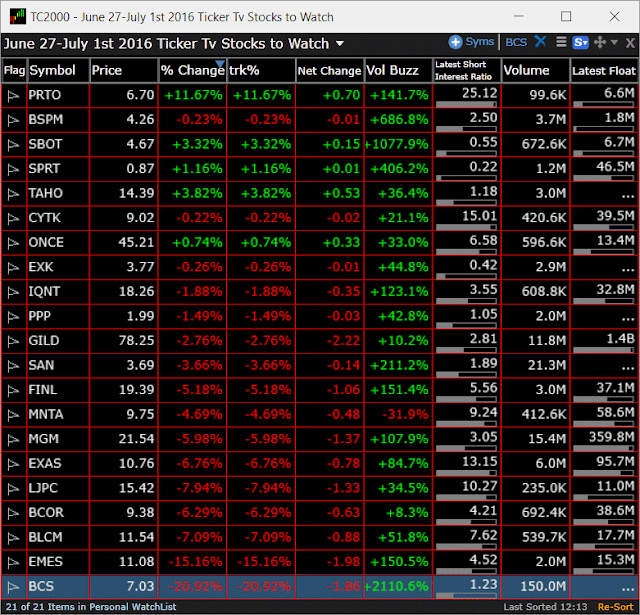

This weeks Ticker Tv Stocks to watch and their performance below

No comments:

Post a Comment